san antonio sales tax rate 2021

Monday-Friday 800 am - 445 pm. It was lowered 15 from 825 to 675 in february 2021.

For Countless American Households Especially Those In More Expensive Markets Higher Loan Limits Open More Opportuni Loan Home Ownership Real Estate Investing

You can print a 7 sales tax table here.

. The 2018 United States Supreme Court decision in South Dakota v. 0500 San Antonio MTA Metropolitan Transit Authority. To review these changes visit our state-by-state guide.

Road and Flood Control Fund. The December 2020. San Antonio Texas sales tax rate.

Thursday July 01 2021. 05 lower than the maximum sales tax in FL. The latest sales tax rate for San Antonio Heights CA.

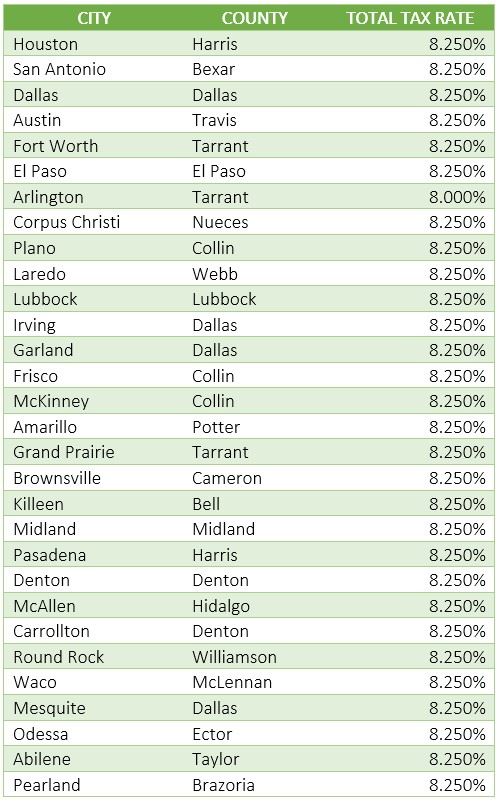

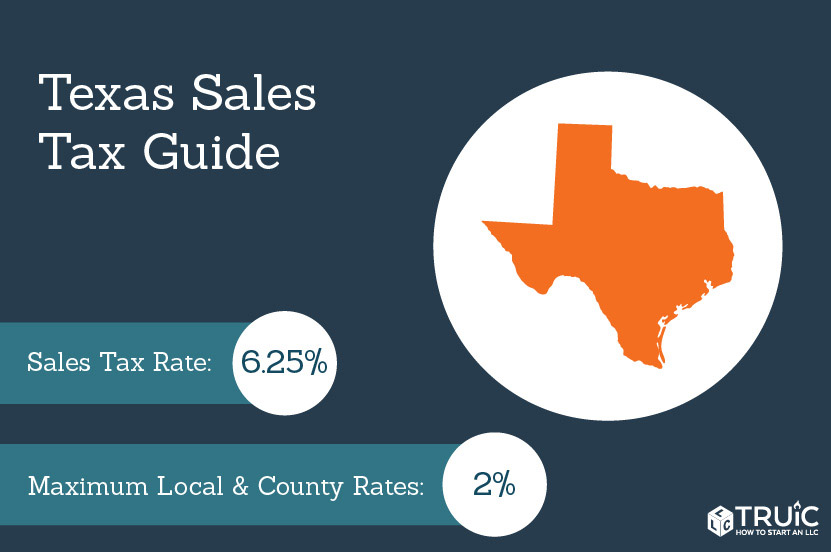

The base state sales tax rate in Texas is 625. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables.

0125 dedicated to the City of San Antonio Ready to Work Program. The rate of revenue growth projected in fy 2022 over the fy 2021 adopted budget is a 32 increase. Popular Counties All A B C D E F G H I J K L M N O P Q R S T U V W Y Z.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. 0250 San Antonio ATD Advanced Transportation District. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected.

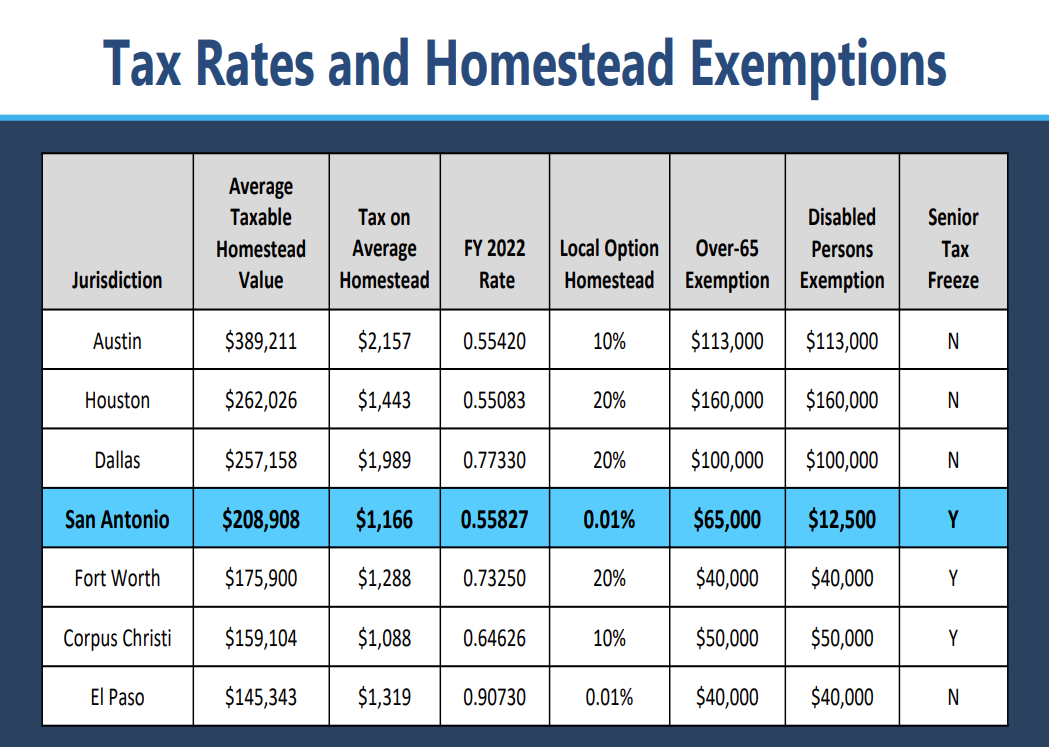

San Antonio Mta Transit 05. Tax Rates The Official Tax Rate Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction. This rate includes any state county city and local sales taxes.

For tax rates in other cities see Florida sales taxes by city and county. 2021 Official Tax Rates. Texas state rates for 2021.

With local taxes the total sales tax rate is between 6250 and 8250. It is a 047 Acres Lot in San Antonio. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

There is no applicable county tax. Look up the current sales and use tax rate by address. 2021 Official Tax Rates.

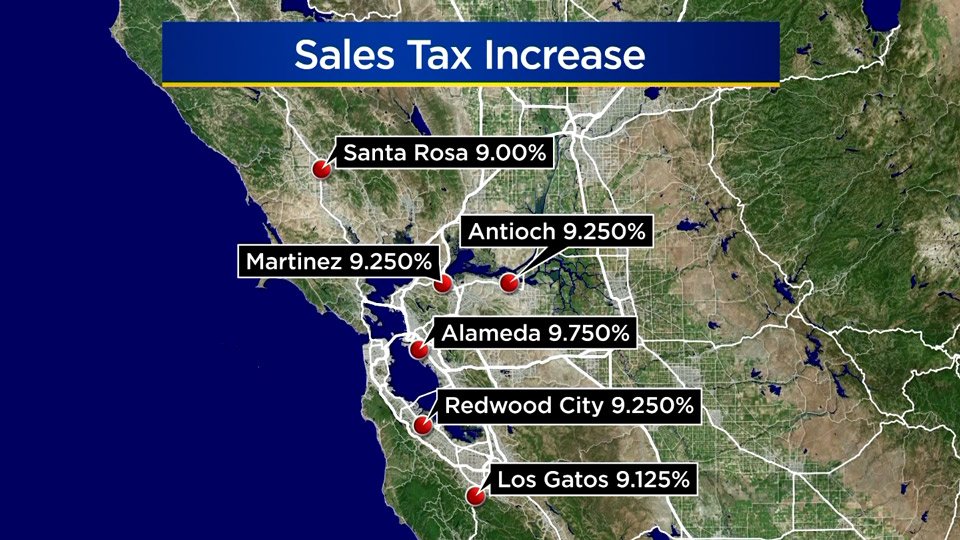

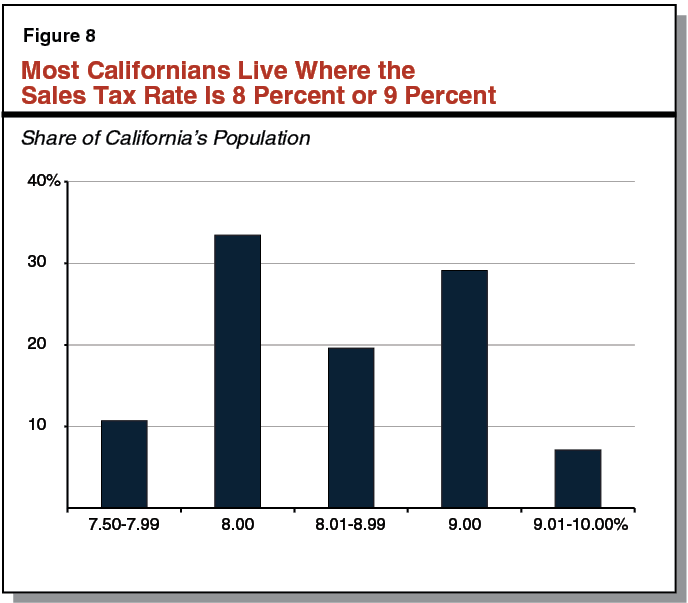

Name Local Code Local Rate Total Rate. Has impacted many state nexus laws and sales tax collection requirements. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

The texas sales tax rate is currently. 0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. San Antonio collects the maximum legal local sales tax.

2020 rates included for use while preparing your income tax deduction. Automating sales tax compliance can help your business keep compliant with changing. There is no applicable city tax or special tax.

San Antonio Atd Transit 025. How Does Sales Tax in San Antonio compare to the rest of Texas. San antonio Tax jurisdiction breakdown for 2022.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. 1000 City of San Antonio.

The San Antonio sales tax rate is a rate of tax a consumer must pay when purchasing goods and some services in Bexar County Texas and that a business must collect from their customers. 4 rows The current total local sales tax rate in San Antonio TX is 8250. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at. The base San Antonio Texas sales tax rate is 125 the San Antonio MTA Transit tax is 05 and the San Antonio ATD Transit rate is 025 so when combined with the Texas sales tax rate of. In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county special purpose district when applicable.

San Antonio TX 78207. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. Texas has recent rate changes Thu Jul 01 2021.

3 Paseo Rioja San Antonio TX 78257 is listed for sale for 300000. The minimum combined 2021 sales tax rate for san antonio texas is. State sales tax rates.

The total local sales tax rate in any one particular location that is the sum of the rates levied by all local taxing authorities can never exceed 2 percent. Box 839950 San Antonio TX 78283. 6 rows The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax.

Sales and Use Tax. San Antonios current sales tax rate is 8250 and is distributed as follows. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825.

The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. Select the Texas city from the list of cities starting with S below to see its current sales tax rate. The estimated 2022 sales tax rate for 78212 is.

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Sky Is Limit For Air Rights In Manhattan Manhattan Sky Air

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Sales Tax Rates Rise Monday Out Of State Online Sellers Included Cbs San Francisco

Annual Change In Energy Related Co2 Emissions 2011 2020 From Iea Report In 2021 Emissions International Energy Agency Dirtier

Marcus Hiles On The Apartment Growth In Dallas Ranking Second Highest In The Nation San Antonio Business Journal Business Journal Press Release Journal

San Antonio Suburb Approves Tax District Mixed Use Suburbs Districts

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Understanding California S Sales Tax

2021 Real Estate Market Real Estate Infographic Real Estate Marketing Marketing

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Texas Sales Tax Small Business Guide Truic

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25